Taxes and Exemptions

System Maintenance Menu -> Configure

System Settings -> Accounting Tab -> Accounts

Receivable -> Tax Codes ->

ADVANCED button -> Tax Exemptions By XXXX

-> TAXES window -> Taxes and Exemptions

System Maintenance Menu -> Configure System Settings -> Accounting

Tab -> Rental Product Classes /

Sales Product Classes / Services -> Taxes and Exemptions

Accounts Receivable Menu -> Customer Information / Customer Site Information -> Codes

window -> Tax Exemptions window -> Taxes

Exemptions

Accounts Receivable Menu -> Account Adjustments ->

A/R Invoices -> Tax window ->

Taxes and Exemptions

Counter Menu / Order Entry Menu -> Customer

Documents -> Tax window -> Taxes and

Exemptions

Document Search windows -> Resulting Document List

-> DETAILS button -> Expanded Details

-> Tax window -> Taxes and Exemptions

This utility can be used to set taxes with the tax

exemptions.

It applies only to the Enhanced Tax processing, as activated in the

Company Taxing Parameters.

The Tax Exemption window is triggered when defining tax and

exemptions for GEOCodes, divisions, cities, Postal/Zip, customers,

sites, product classes, services, and also when reviewing tax

exemptions on the document.

- The ability to change the Tax Codes is controlled by

operator permission setup in Security Role

Permissions.

If an operator does NOT have role permission to change taxes, this

window becomes view only.

-

A flag in the Company Taxing Parameters

can be set to cause all Site, Customer, and Division tax exemptions

to be respected on the document.

-

If your firm elects NOT to recognize all Site, Customer, and

Division tax exemptions, the following exemption rules apply:

- The site on the document is first checked for any exempt flags,

as setup in Tax Exemptions By Site. If any

site tax exemptions are identified the search for further

exemptions ends, even if these exempted site tax codes do not apply

to this document.

- If there are no site exemptions, then exemptions for the

customer on the document apply as setup in Tax

Exemptions By Customer.

- If there are no Site or customer exemption flags, divisional

exemptions apply as determined by Tax

Exemptions By Division.

Note: Tax Exemptions By Class and

Tax Exemptions By Service exemptions apply

regardless of Site, Customer, or Division exemptions.

Refer to Tax Maintenance Overview for

Enhanced Tax Rules.

TAX EXEMPTIONS

Depending from where this window is

triggered, it can be used to setup the relevant tax codes and

exemptions, or it is information only if the operator does not have

role permission to Change Tax Codes.

The prompts in the Exemption window are:

-

- SEQ

- The sequence number tracks the tax exemption records in the

file.

Multiple tax exemption records can be recorded for each GEOCode,

document, customer, site, division, class, or service.

CODE- Enter the Tax code or select it from the drop-down list as

setup in Tax Codes.

- Shortcut to set Tax codes & Exemptions:

- If * (asterisk) is entered in the Code field in place of

an actual tax code, tax codes with exemptions can be defined as

outlined in Add Missing Tax Codes.

This utility is only offered for Sites, Customers, Divisions,

Classes, and Services.

DESCRIPTION- The Tax code description displays.

EXEMPTIONS- Separate Exemption flags can be entered for each of Rentals,

Sales, Services, and Damage Waiver, or the flags can be selected

from the drop-down lists provided.

This data is reflected with the Tax details on the spreadsheet

output of the Site Report and the Customer Discounts & Tax Status Report.

- RENTALS

- This field does not apply to Services.

Set the tax exemption flag that should apply to Rentals for this

tax as follows:

- Leave this field blank if Rentals are not exempt from this

tax.

- Type Y (YES) if Rentals are Exempt from this tax.

- Type O (Omit) to totally omit this tax for Rentals.

On documents, the O option is only offered on the document

header and if selected will cause this tax to be omitted on all

rental details on this document.

SALES- This field does not apply to Services.

Set the tax exemption flag that should apply to Sales for this

tax as follows:

- Leave this field blank if Sales are not exempt from this

tax.

- Type Y (YES) if Sales are Exempt from this tax.

- Type O (Omit) to totally omit this tax for Sales.

On documents, the O option is only offered on the document

header and if selected will cause this tax to be omitted on all

sales details on this document.

SERVICES- This field does not apply to Products or Classes.

Set the tax exemption flag that should apply to Services for

this tax as follows:

- Leave this field blank if Services are not exempt from this

tax.

- Type Y (YES) if Services are Exempt from this tax.

- Type O (Omit) to totally omit this tax for Services.

On documents, the O option is only offered on the document

header and if selected will cause this tax to be omitted on all

services details on this document.

DMG WAIVER- This field does not apply to Products, Classes, or Services.

Set the tax exemption flag that should apply to Damage Waiver

for this tax as follows:

- Leave this field blank if Damage Waiver is not exempt from this

tax.

- Type Y (YES) if Damage Waiver is exempt from this tax.

- Type O (Omit) to totally omit this tax for Damage Waivers.

EXEMPT #- This field only applies to the customer and site exemptions.

Enter the tax exemption number if it is available.

This tax exemption number will print in the document comments when

applied to Sales or Rental exemptions.

- EXEMPT TYPE

- This is a free format field to associate with this

exemptions.

- EXPIRY

- This is an information date only which does not impact the

calculation on the document.

Finished?- Click ACCEPT to accept or CANCEL to abort.

ACTIONS:

Additional actions to bulk load or bulk

delete Tax Exemption records are provided by buttons on the

Taxes and Exemptions setup screen when called from one of

the following utilities:

Note: Only Tax codes with some exemption flags are added to the

table.

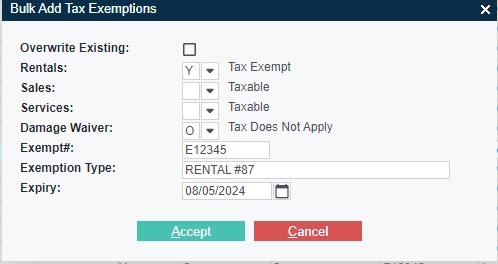

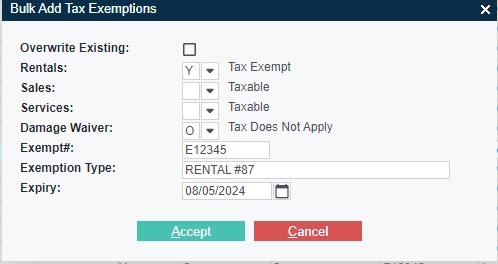

- Add All Taxes & Set the Relevant Exemptions:

The BULK ADD button can be used to add all Tax Codes to the target Tax Exemptions By

XXXX (where XXXX is the currently accessed Site, Customer,

Division, Class or Service record) and to define the default

Exemption settings in the following example pop-up window:

After setting the defaults click ACCEPT to populate this

specific Tax Exemption table or CANCEL to abort.

Individual Tax code records can be modified for this Site,

Customer, Division, Class or Service as required.

Note: The 'Exempt#', 'Exemption Type' and 'Expiry' values only

apply to the Customer and to the Site tax records.

-

Delete All Exemptions:

The BULK DELETE button can be used to remove all the

Tax Codes from the Tax Exemptions By

XXXX (where XXXX is the Site, Customer, Division, Class or

Service record).

This is a useful cleanup tool.

Confirmation is required.

Topic Keyword: DCTX01