Job costing tracks revenues and expenses by job at the posted

G/L level, by posting to the G/L account assigned to the job

defined in Job Cost Codes.

For more information on this feature refer to Job Costing Overview.

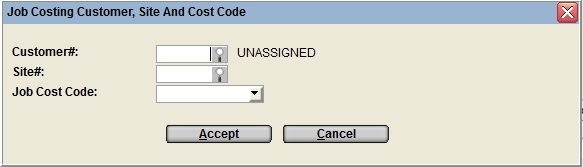

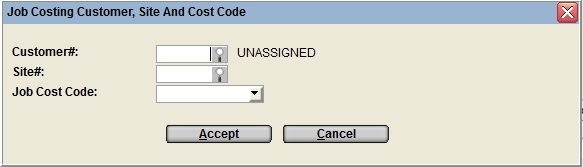

This pop-up window only appears if the Enable Job Costing

feature is activated in the Company Posting

Parameters.

Close the window if job costing does not apply to this transaction,

or capture the job information for the G/L or A/P transaction as

follows:

The G/L account associated with this Job Cost Code becomes the posting account.

In A/P Invoice Details and in A/P Invoice Details by P.O. this Job Cost option can be useful expensing miscellaneous costs on a job, or for Sales products that are immediately expensed and are to be used on a job, or for re-rented equipment costs, but it is not recommended for use when receiving and invoicing Rental Equipment as the posting of the inventory cost goes to the job cost account and the Inventory Asset account in the G/L is not updated by the value of the asset purchased.

In A/P Invoice and in A/P Invoice by P.O. the "Default Job Cost Info

from AP Invoice Header" flag in the Company

Miscellaneous Parameters controls whether the Customer, Site

and Job Cost code information defaults from A/P Invoice header to

the detail transactions.

When this parameter is unchecked the operator is forced to select

the appropriate Job Cost information for each line rather than just

accept a defaulting value.

| Converted from CHM to HTML with chm2web Pro 2.85 (unicode) |